Ensuring Financial Compliance for Corporate Business

In Myanmar’s evolving business landscape, financial compliance is a critical pillar for corporate success. Whether you’re a local enterprise or a foreign-invested company, staying compliant

In Myanmar’s evolving business landscape, financial compliance is a critical pillar for corporate success. Whether you’re a local enterprise or a foreign-invested company, staying compliant

Starting and operating a business requires more than just a great idea—it demands compliance with legal and regulatory requirements. Among these, having the necessary licenses

One of the easiest ways for business owners to mess things up is by failing to maintain proper financial records for their businesses. Unless a

Navigating tax and compliance regulations in Myanmar can be a complex and time-consuming task for businesses. From understanding ever-changing legal requirements to meeting tight deadlines,

What are Corporate services, and Why Do Businesses Outsource? Corporate services refer to a range of support activities that businesses need to operate efficiently, such

Managing your business’s finances effectively hinges on understanding the distinct roles of bookkeepers and accountants. While both are vital, their functions and skill sets differ

Bookkeeping is the process of recording, organising, and maintaining a company’s financial transactions and activities. For small and medium-sized enterprises (SMEs), a strong bookkeeping system

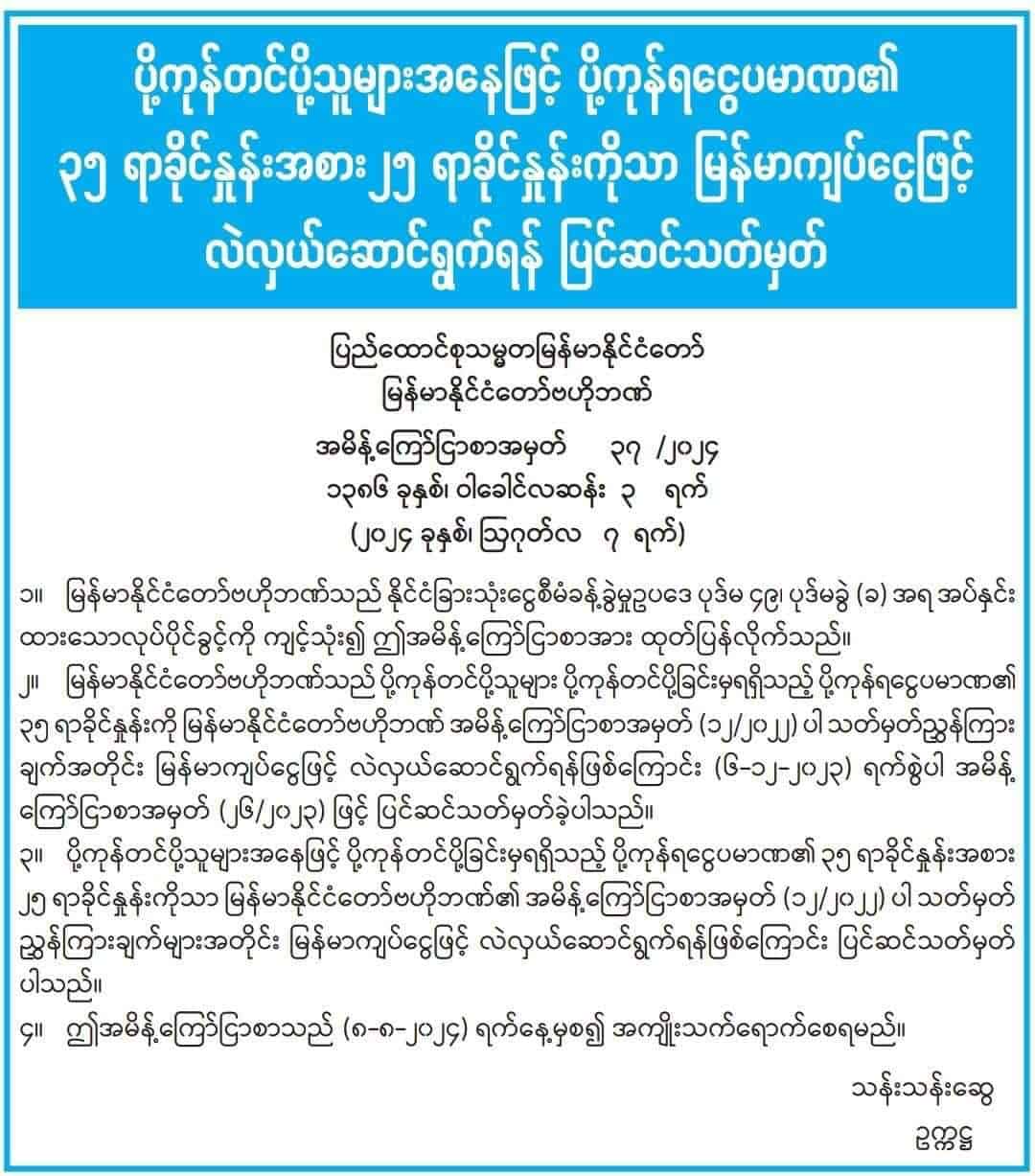

The Central Bank of Myanmar (“CBM”) has issued Notification No. 37/2024. In this announcement, the Central Bank revises the regulations outlined in Notification No. 26/2023,

Entering a new market provides multinational corporations (MNCs) with a unique set of challenges. Navigating unfamiliar regulatory landscapes, managing compliance, and maintaining accurate records can

Nowadays’ globalised economy, business expansion is increasingly becoming an essential part of many companies’ growth strategies. Venturing beyond domestic markets to seek opportunities in foreign countries, a process known as international expansion, can significantly enhance a company’s market reach, competitive edge, and overall profitability.

In today’s business world, “data” is one of the most powerful weapons businesses can have. Financial data, which serves as the lifeblood of decision-making processes,

In today’s fast-paced business environment, having reliable accounting and bookkeeping solutions is essential for maintaining financial health and compliance. However, many companies face the choice

As we approach the end of the year, businesses across Myanmar are gearing up for a critical process: wrapping up their financial affairs. The financial

As the financial year is about to end, businesses are gearing up to chart their course through the ever-changing landscape of commerce. While innovation, market

Essential Legal Considerations for Business Acquisition in Myanmar

Renewing your Foreigner Registration Certificate (“FRC”) for foreigners residing in Myanmar before December 31st is essential. Beyond being a legal obligation, it is a crucial

Published: June 7, 2021Updated: March 21, 2022 Background Many foreigners have expressed interest in returning to Myanmar and subsequently contacted FocusCore Myanmar to receive an

Top 3 benefits we want to share, which our clients have experienced after they decided to outsource their bookkeeping and accounting; especially during COVID-19 where

As the financial market in Myanmar tries to reform from a collateral-based loan to credit-based system, having a GAAP accounting system to monitor the company’s

As Myanmar catches up with the rest of the world with the spread of COVID-19, it becomes apparent that the effects of the ‘Great Lockdown’

Founded in 1997, Lippotex Industries produced sportswear and knitted garments for export markets. Adapting the changes of market and world economy, they then expanded their

The mission of AMCHAM Myanmar is to promote and connect American business in Myanmar by encouraging local partnerships and upholding the highest business standards. The

Foreign Banks operating in Myanmar can now open branches across all of Myanmar to provide banking services to retail customers. This has been awaited eagerly

Insurance is an important global service – vital to commerce and private individuals. 1.) Why is insurance important to an emerging market? 2.) How does

International Chambers of Commerce in Myanmar from Australia, Britain, Europe (EU), France, Germany, Italy, and The United States have come together as signatories to publish

In our blog of last November we outlined the news of a new Directive, issued by the Central Bank of Myanmar (CBM), authorising wholesale banking

September 2018 FocusCore Myanmar published a blog with the headline “MYANMAR opens its doors to Overseas Insurance companies – contact FocusCore today”. Now, following more

A service to provide background checks for lenders is finally going to open in Myanmar – Myanmar Credit Bureau Limited, MCBL. Over the last three

A new Directive has been issued by the Central Bank of Myanmar (CBM). Wholesale banking services are now allowed to be supplied by foreign banks

In October the Myanmar Investment Commission (MIC) launched the Myanmar Investment Promotion Plan (MIPP). The aim, to attract more than USD 200 billion over the